The European General

Court decided last week that the Irish tax ruling agreements with Apple do not

infringe European Union Law (Judgement of 15.07.2020, T-778/16 and T-892/16). The tax benefits obtained do not

constitute unlawful state aid as prohibited under Article 107(1) TFEU. The

Court hence annulled the decision of the European Commission that Ireland

granted illegal state aid. In consequence, Apple does not have to repay taxes plus

interest and saves approximately 14 bn USD.

|

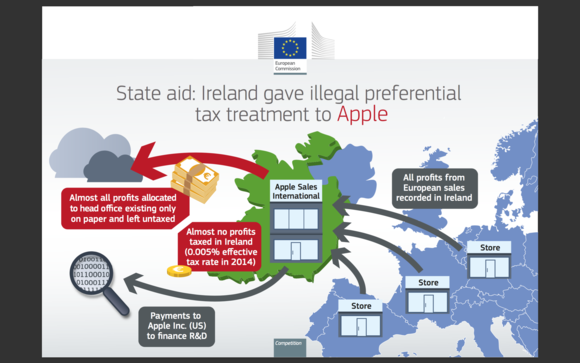

| Infographic of the EC |

Tax rulings came into the focus of the European

Commission since 2013. The state aid control formed a major part of its new

strategy to discover and prevent tax abuse in the European Union. Article

107(1) TFEU prohibits the grant of selective advantages by a Member State,

which at least threatens to distort competition and affect trade between Member

States. The investigations included tax rulings of several countries granted amongst

others to Amazon, Apple, Fiat, McDonald’s and Starbucks.

The Apple case

concerned tax rulings adopted by the Irish tax authorities in 1991 and 2007.

The tax rulings determined in advance the profit allocation of two Apple

subsidiaries. Apple Operations Europe and its fully owned subsidiary Apple

Sales International were incorporated in Ireland without being tax resident

therein. A cost-sharing agreement with the parent Apple Inc. granted them

royalty-free Apple licences to manufacture and sell products outside from North

and South America. Each subsidiary established a branch for this purpose in

Ireland. The company structure differed thereby from the typical “double Irish”

tax scheme, which includes two separate Irish enterprises and not the use of separate

branches within an enterprise. The latter is a particularity of the Apple case,

whereas both schemes result in a low effective taxation. The subsidiary

Apple Sales International was managed and controlled from a head office outside

from Europe but sold products through its separate branch in Ireland.

Nevertheless, profits were allocated to the head office outside from Ireland

and determined in accordance with the tax rulings. As a result, only a small

part of the profits was considered taxable in Ireland.

In 2014, the

European Commission started a formal investigation procedure against Ireland

pursuant to Article 108(2) TFEU and adopted its decision in 2016. Accordingly,

the tax advantages received through the tax rulings gave rise to unlawful state

aid under Article 107(1) TFEU.

The European

General Court came to a different conclusion and ruled that the Irish tax

rulings do not fulfill the requirements for unlawful state aid. In particular,

the European Commission had not fulfilled its burden of proof as it “did not

succeed in showing the requisite legal standard that there was a selective

advantage for the purpose of Article 107(1) TFEU”, the European General Court

stated. But the Court also confirmed that Member States must exercise their

exclusive competence in the field of direct taxation in consistence with European

Union Law likewise in the Fiat and Starbucks judgements.

The European

Commission based its argumentation on the breach of the arm’s length principle

and the failure of Ireland to allocate profits to the branches rather than to

the subsidiaries. The arm’s length principle is a profit allocation method

applied for intra-group transactions in order to determine prices under market

conditions. The allocation of Apple IP licences to either the subsidiaries or

the branches was in this case a decisive issue. Even if the arm’s length

principle is not part of the Irish domestic law, the European General Court

agreed in so far with the European Commission that the principle is a general

rule setting a benchmark (see also Judgement of 22.06.2006, C-182/03 and C-217/03). However, the Court rejected the

argumentation that the Irish tax authorities should have allocated the IP licences

to the branches for the profit determination of the subsidiaries in Ireland.

The European Commission had not proved sufficiently that the actual activities,

functions as well as strategic decisions lead to an allocation to the branches.

In conclusion, the Court hold that the tax rulings did not constitute illegal

state aid under Article 107(1) TFEU. Still, the judgement is not legally

effective as the European Commission may submit its appeal to the European

Court of Justice.

Author: Stella Langner

Stella Langner, Ref. iur., is a PhD candidate and

research assistant at the chair of Prof. Dr. Matthias Valta in the field of

international tax law at the University of Düsseldorf. She completed her law

studies at Heidelberg University and Yeditepe University (Turkey) in 2017.

Brak komentarzy:

Prześlij komentarz